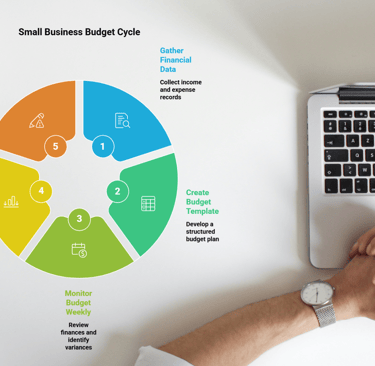

Small Business Budgeting Guide: Create a Roadmap for Profit in 2025

Learn how to build an effective business budget, monitor variances, and adjust forecasts. A practical guide for small business owners with actionable steps and real-world examples.

REPORTING

Jerry Blanco

7/6/20255 min read

Transform Your Business Dreams into Financial Reality with Smart Budget Planning

Picture this: You're sitting at your kitchen table at 11 PM, staring at a pile of receipts and wondering if you'll have enough cash to cover next month's expenses. Sound familiar? If you're a small business owner, you've probably been there. The good news is that creating a solid business budget doesn't require an accounting degree – just the right roadmap and a little patience with yourself.

Think of your business budget as your financial GPS. Just like you wouldn't drive cross-country without directions, you shouldn't run your business without a clear financial plan. Let's walk through how to build an effective budget that actually works for your real-world business.

Why Most Small Business Budgets Fail (And How Yours Won't)

Before we dive into the how-to, let's address the elephant in the room. Most small business owners either skip budgeting entirely or create budgets that gather digital dust. Here's why traditional budgeting fails:

It's too complicated: Many budget templates look like they were designed for Fortune 500 companies

It's set-and-forget: Real businesses are dynamic, but most budgets are static

It's based on wishful thinking: "If I just believe hard enough, I'll hit these numbers"

Your budget should be a living, breathing tool that grows with your business, not a rigid document that makes you feel guilty when reality doesn't match your projections.

Building Your Business Budget Foundation

Start with What You Know

Before you can plan where you're going, you need to understand where you are. Gather these three pieces of information:

Your actual income for the last 3-6 months (not what you hoped to make, but what actually came in)

Your fixed expenses (rent, insurance, loan payments – the bills that stay the same each month)

Your variable expenses (supplies, marketing, travel – costs that fluctuate)

Don't have perfect records? That's okay. Start with your best estimates and improve your tracking going forward. Perfect is the enemy of good when it comes to budgeting.

The 50/30/20 Rule for Small Businesses

While personal finance experts recommend the 50/30/20 rule for individuals, small businesses need a different approach. Here's a framework that works for most small businesses:

60% for operating expenses (rent, utilities, supplies, marketing)

25% for owner compensation (yes, you deserve to pay yourself)

15% for taxes and savings (trust me, future you will thank present you)

This isn't set in stone – service businesses might have lower operating expenses, while product-based businesses might need more for inventory. Adjust based on your business model.

Creating Your Monthly Budget Template

Your budget should include these key categories:

Revenue Streams:

Primary income source

Secondary income sources

One-time project income

Fixed Expenses:

Rent/mortgage

Insurance

Software subscriptions

Loan payments

Variable Expenses:

Marketing and advertising

Professional services

Office supplies

Travel and entertainment

Owner Expenses:

Owner salary/draw

Health insurance

Retirement contributions

Monitoring Your Budget: The Reality Check

Creating a budget is like buying a gym membership – it's the showing up that makes the difference. Here's how to stay on track without becoming a spreadsheet slave:

The Weekly Money Date

Schedule 30 minutes every week to review your finances. I call it a "money date" because it sounds less intimidating than "budget review." During this time:

Compare actual income to projected income

Review major expenses from the week

Identify any surprises (good or bad)

Adjust next week's spending if needed

Understanding Budget Variances

A variance is simply the difference between what you planned and what actually happened. Don't panic when you see variances – they're normal and informative.

Positive variances (you made more or spent less than planned):

Celebrate, but don't immediately increase your lifestyle

Consider if this is a one-time event or a new trend

Use extra income to build your emergency fund or pay down debt

Negative variances (you made less or spent more than planned):

Don't beat yourself up – investigate instead

Ask: "Is this a one-time event or do I need to adjust my budget?"

Look for patterns over 2-3 months before making major changes

The Traffic Light System

Here's a simple way to monitor your budget health:

Green: Variances under 10% of budgeted amount

Yellow: Variances between 10-20% (pay attention but don't panic)

Red: Variances over 20% (time to investigate and adjust)

Adjusting Your Forecasts: Rolling with the Punches

Your budget should evolve with your business. Here's when and how to make adjustments:

Quarterly Budget Reviews

Every three months, sit down with your budget and ask these questions:

Are my revenue projections realistic? If you're consistently over or under by more than 15%, it's time to adjust.

Have my expenses changed permanently? Maybe you hired an assistant or moved to a larger office. Update your budget to reflect your new reality.

What surprised me this quarter? Unexpected expenses often become expected expenses once you know to plan for them.

Seasonal Adjustments

Many small businesses have seasonal fluctuations. Your budget should reflect these patterns:

Service businesses: You might see slower periods during holidays or summer months

Retail businesses: Holiday seasons typically bring higher revenue and expenses

B2B businesses: Many corporate clients have slower decision-making in December and August

Track these patterns over time and build them into your budget rather than being surprised by them each year.

Advanced Budgeting Strategies for Growing Businesses

The Three-Scenario Approach

As your business grows, consider creating three budget scenarios:

Conservative: Based on your worst-case reasonable scenario

Realistic: Based on your most likely scenario

Optimistic: Based on your best-case scenario

This approach helps you plan for different outcomes and makes you more resilient when things don't go according to plan.

Revenue and expenses don't always align perfectly with your budget timeline. Cash flow forecasting helps you predict when money will actually hit your bank account.

For example, if you invoice a client in March but don't get paid until May, your cash flow forecast should reflect the May payment, not the March invoice date.

Technology Tools That Don't Require a PhD

You don't need expensive software to create an effective budget. Here are three approaches that work:

Simple Spreadsheet: Start with a basic Excel or Google Sheets template. It's free, flexible, and you probably already know how to use it.

Accounting Software: Tools like QuickBooks Simple Start or Xero can automatically categorize expenses and create budget reports.

Budgeting Apps: Apps like YNAB (You Need A Budget) or Mint can work for very small businesses with simple needs.

The best tool is the one you'll actually use consistently.

Red Flags: When Your Budget Needs Emergency Attention

Watch out for these warning signs:

Cash flow problems despite profitable operations

Consistently missing budget targets by more than 20%

Inability to pay yourself regularly

Growing debt without a clear repayment plan

Seasonal cash crunches that catch you off guard

If you're seeing multiple red flags, it might be time to get professional help from a bookkeeper or accountant.

Your Next Steps: From Planning to Profit

Building a budget isn't a one-time task – it's an ongoing process that gets easier with practice. Here's your action plan:

This week: Gather your financial information and create your first budget using the framework above

Next week: Schedule your first weekly money date

This month: Track your actual income and expenses against your budget

Next quarter: Complete your first quarterly budget review and make adjustments

Remember, your budget doesn't have to be perfect – it just has to be better than flying blind. Start simple, stay consistent, and refine as you go.

The goal isn't to create the perfect budget; it's to create a financial roadmap that helps you make informed decisions and sleep better at night. Your business deserves that level of intentional financial planning, and so do you.